Webinar Overview: GeoInsurance UK 2022

- December 20, 2022

PROPERTY LEVEL ASSESSMENT OF CLIMATE RISK AND IMPACT. WHAT ARE THE CORE REQUIREMENTS?

KEY TAKE-AWAYS:

- The market view on capturing data as a primary objective in helping smaller insurers and MGAs report on climate-related risks.

- Taking a step towards measuring climate related impacts on existing books of business – in terms of physical (value exposure) and transitional (emissions) risk.

- Starting the journey – an approach to reporting on climate-related property risk reporting – help is just a conversation away.

Over the last few years, the GeoInsurance webinar series have aimed to keep the insurance and other sectors up to date on what’s happening – with a special focus on data, peril data, climate change and ESG.

We continue this theme with a review of data that can help with property level assessment of climate change impact. We will look at the regulatory landscape, as well as how flood and emissions data can be measured and reported on to help with regulatory submissions (Property class assets).

Insurers and MGAs are engaged on net zero journeys leading the way with positive policies to tackle climate change.

One such requirement within ESG reporting is the measurement of risks and impacts that their property books face.

Hosted by Richard Garry, the UK webinar explored some of the challenges and practical approaches taken to track and report on risks and impacts of property class assets.

The Gamma Location Intelligence team was joined by Michael Keating, MGAA, who provided a appraisal of where the market is today and the need to be ready for what is to come next Feargal O’Neill, Gamma, then took the session through some of the common approaches adopted by various insurance, banking and financial services brands in terms of what may be requires in climate-related disclosure.

The session was then concluded by Jason Day, Gamma, who walked through a suggested reporting process that is aimed to “ease of pain” for smaller insurers and MGAs – a standardised reporting mechanism to help start that climate-related disclosures journey.

CAPTURING DATA – a key weapon in the MGA armoury when facing the climate challenge

Michael Keating – CEO of the MGAA – focused his session on the MGA market and how MGAs are looking at the impact of climate change.

Essentially, to set the scene as to how the MGAA has been talking with respective members on where they are in relation to ESG and data, then the key message is that:

Capturing data will become mandatory.

Unequivocally.

With c:50 insurers as part of the MGAAs membership – without exception – despite being at differing points in their ESG journey, insurers are already discussing with MGAs and distribution partners areas around capturing ESG.

Some have been very public around what their intentions are towards achieving net-zero targets. These are certainly ahead of the curve in terms of their journey. Determining what data to collect, and how they can collect it. Whilst others are making great strides.

Clearly – coming back to the collection of data and the very real scars that people have felt most recently in this area in relation to reporting on fair value – there is no doubt that there will be a further request for ESG data and reporting over the next 12-months and beyond.

That will of course present challenges and opportunities within the distribution chain.

If the insurers are asking for data from MGAs, then (in turn) MGAs will need to gather data from their brokers – and ultimately the client – to satisfy the request further up the chain.

This is not going away.

It will ramp-up over the next 12 to 18-months.

There are questions as to how that data will be collated – the need to standardise or otherwise.

But to be clear – it will put further pressure into the value chain.

The other area that is important – with insurers looking to achieve net-zero and capturing the requisite data – is that there will be consequences.

Be that a potential change in risk appetite, the withdrawal from some/certain sectors (resulting in less choice), ESG pricing, and changes to the supply chain profile (ie. the need for suppliers to be ESG compliant).

And whilst it’s easy to consider this as something that is on the horizon – in fact it’s very much here now…!

Encouraging signs

However, there are encouraging signs from all sides, with insurers and Lloyd’s there is a definite view that this is a transitional period.

They are working with MGAs and partners to ensure that the transition is smooth and managed – as opposed to simply dropping the request to conform.

So, providing that collaboration persists and the interactions across the value chain remains healthy and constant – and with the MGAA at the heart of that – then the industry will come through the challenge.

The only real concern is if that collaboration becomes cloudy – then issues will undoubtedly arise.

So, the MGAA’s message to all stakeholders is remember it’s a transitional period, remember that everyone is on a journey – expecting to achieve a common goal – but ensure that communication is timely, regular, and takes account of everyone in the value chain.

MEASURING CLIMATE RISKS AND THE IMPACTS ON PROPERTY BOOKS

So, if data is key, what data is appropriate, what is available and what are the pitfalls?

Feargal O’Neill, CEO at Gamma, focused on how insurance and asset owners can start to address the long-term impact of climate change by understanding what projected impacts will do to existing books of business (or owned/managed property assets).

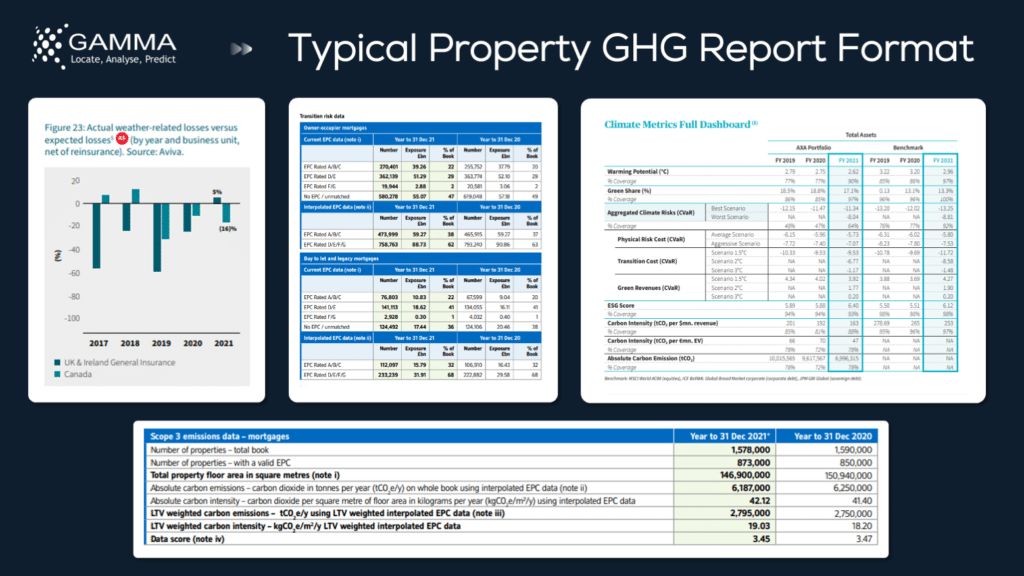

Slide Image 1: What do insurers try to measure?

How is the insurance sector measuring up..?

Climate change is increasing property risk and making those risks less predictable. Compounding that is the fact that property is increasing the risk of climate change through emissions – a circular, spiralling effect if left unchecked.

Consequently, any large organisation with a property portfolio needs to assess physical risks (those associated with the impact of climate change on that portfolio) and transitional risks (those associated with emissions and moving to a lower carbon economy).

Physical risks

For insurers, physical risk assessment is a relatively simple process to undertake. It requires some modification to existing models that are well understood and that have been utilised is assessing perils over many years.

When considering physical risks through the impact of climate change, we are generally seeing more frequent, more intense, yet less predictable events.

From an insurance perspective this insight needs to be factored into pricing. Whilst from an investment perspective there is a need to understand the potential for a loss in value of the investment over time due to climate impacts.

As such, forecast models need to consider the potential scenarios that exist in terms of representative concentration pathways (RCPs) that project impacts based on differing increases in temperature warming across various time horizons or periods.

Whether a business takes a moderate or hard-line view on what the outcomes predict is currently at their behest – but assessing the impact needs to start.

Slide Image 2: Physical risk impact on property

Transitional risks

Traditionally these risks have not been measured – it is harder, it is newer, and will only become more complex as regulators stipulate the disclosures that organisations will need to make.

So how does that relate to property risk and impact..?

Essentially this is focused on high emission, inefficient properties, and the risk they represent to the insurer and/or the investor as society moves to a net-zero economy.

Many organisations have set expectations and made pledges to achieve net-zero – as such the overarching risk is one of reputation. Be that in terms of investors, employees, regulators, and customers – all of whom have the potential to take action if emissions are not being reduced.

Alongside this there is also the potential loss in asset value, as the property become less desirable and the financial consequences of holding poo performing properties in terms of emissions in your portfolio.

Slide Image 3: Transitional risk impact on property

So how do we report, track, and measure these changing risks..?

In terms of physical risk from an insurers perspective, there are currently 2 primary measures:

- Total value at risk (VaR), and

- Actual versus expected losses – the continuous appraisal of how well the model is performing.

For transitional risk, measurement is focused on emissions:

- Total GHG emission from the property portfolio – from absolution emission to emissions intensity.

Various institutions, partnerships, and action groups have collaborated to define standards in relation to these measurements with a focus on ensuring that it is easier for financial institutions to report consistently.

The TCFD (Taskforce for Climate-related Financial Disclosures) is perhaps the most well-known of these bodies – having produced what many other representative bodies reference as the standard in this area.

Perhaps the most practical interpretation and guidance comes from the PCAF (Partnership for Carbon Accounting Financials). Most recently they have partnered with the Net-Zero Insurance Alliance (NZIA) to produce an insurance related version to advise on standards, metrics, and methodologies for calculating carbon emissions and policies.

Estimating emissions

So how do you establish the estimated emissions for an individual property..?

From a residential (or domestic) property perspective, information exists for individual properties in terms of their BER or EPC rating – this is not comprehensive but can be utilised in a model to determine the rating of those that are similar in characteristics.

Then through a data enrichment process, portfolios can be tagged and reported upon to gain a comprehensive view and benchmark. Having determined this, organisations can adopt strategies to combat and improve their emissions position.

In terms of commercial properties, the modelling of BER or EPC rating is more challenging.

Large companies will disclose their emission. However, that is limited.

One approach is in relation to the activity that the organisation performs within any given property or location, but there is much debate on how to simplify this measurement.

The key takeaway is that capturing, measuring, and reporting will only become more onerous. Therefore, the learned advice is to make a start, be flexible and evolve.

Slide Image 4: Example climate disclosure reports for insurance & banking brands (Aviva, AXA, HSBC & Nationwide)

Challenges

The biggest challenge is around the lack of data – there are a number of assumptions, and models that need to be used in order to achieve a baseline measure from which organisations can start their journeys towards a net-zero economy.

There are potential issues around GDPR to accurately define what constitutes personal information versus building information.

BER/EPC data is based on average usage – as such there is the inherent challenge around the accuracy of the measures being applied.

Virtually no standardisation exists between countries – although there are movements under way to do that.

Physical risk models are new, albeit based on understood methodologies – but there is still advancement and enhancement that is required in this area.

Slide Image 5: Challenges, but support is just a conversation away

But ultimately this is a huge task – one that will become more comprehensive. Complex. Onerous.

Yet despite all of this, making a start will only hold you and your business in good stead as things evolve.

MGAs – Stick or twist..?

Many of the examples provided above perhaps apply more directly to larger insurers and banking/financial institutions.

However smaller insurers and MGAs – as Mike would say “other stakeholders in the value chain” – have a job of work to do as well.

Whilst it’s not yet mandated, regulators are certainly looking to expand the scope of who needs to report. Capacity providers will need to disclose this information, so having property data encoded with physical and transitional risk attributes will become more crucial and advantageous. As such, smaller insurers and MGAs are very much part of the process.

And over time it will become more complicated – at present the focus is on climate change adaptation and mitigation – but the direction of travel is such that over time other aspects (ie. biodiversity and pollution) will become important to measure too.

That said, there is a useful document produced by Lloyd’s back in 2021 in terms of their guidance for MGAs. This may be a useful point of reference to start that journey.

If accurately reporting emissions is challenging, should organisations wait until better data is available?

The consistent advice is – do not wait.

There is a general acceptance across all the aforementioned standards agencies and regulators that there is a huge lack of data. Guidance is to use the best data that is available.

And build on it over time. This is deemed to be a better approach than not producing any disclosure reporting at all.

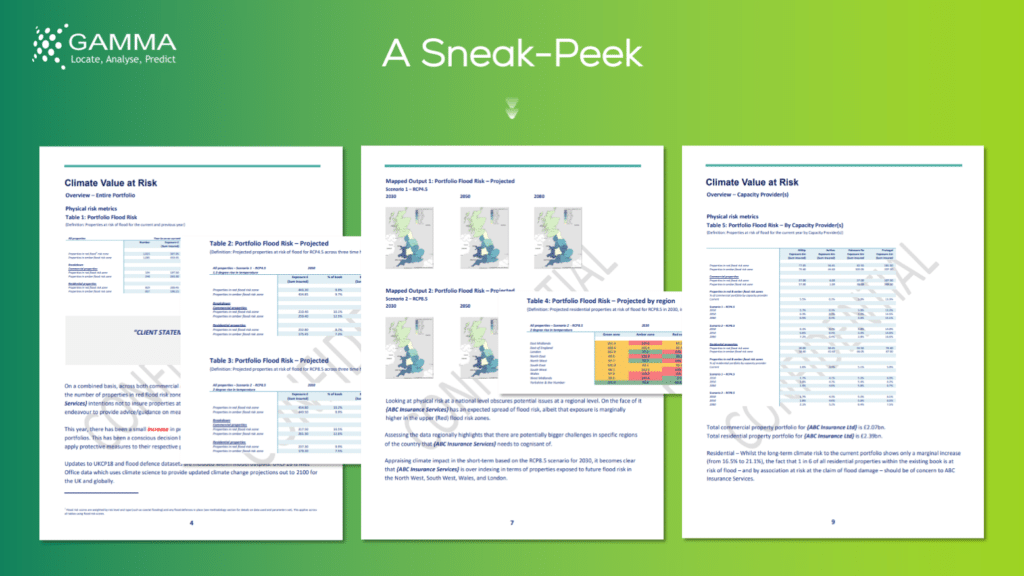

Climate change property risk reporting

So, a conundrum exists.

A sense of urgency and advice to report on climate-related impacts, versus a lack of data and non-mandated approaches as to what best to provide.

However, the potential to provide a short-term fix is the primary focus for the final part of the session, overviewed by Gamma’s Head of Location Intelligence, Jason Day.

Nothing worth doing is easy

In short, take a step towards reporting on climate-related property risk is hard… it’s painful… and it’s possibly not a surprise that many are taking a stance of “wait and see” before taking a step.

Frankly, it is always easier to do something else.

And Gamma understands that. There are always plenty of other pressures for a business of any size to contend with.

However, the prescribed wisdom is “do something”. Make a start.

Start the journey, but remain fluid

During 2022, Gamma has examined ways of potentially helping clients and prospects achieve their climate-related reporting needs. Without the need to invest significantly.

The challenge is understood and appreciated. And whilst there is very little set-in stone from a regulatory perspective, there are potential options for alleviating any forthcoming pain.

Slide Image 6: Report illustration for climate value at risk (CVaR)

From a physical risk measurement perspective, Gamma would recommend appraising climate-related impacts on the current book of business. This could be across various perils but would aim to provide guidance or directional insight as what strategies the client should put in place to combat both losses and a reduction in the value of their book.

However, the recommendation is that this is viewed not only in aggregate across the entire book, but also in line with those properties or assets that are underwritten by specific capacity providers. In fact, it’s the drilling down into the detail of the insights that can often highlight unforeseen exposures that are not obvious when appraised at the aggregate or individual property level.

Insight would be provided by property type – residential and/or commercial. Measured in reference to a baseline (or control year). Across agreed RCPs (representative concentration pathways) and time horizons.

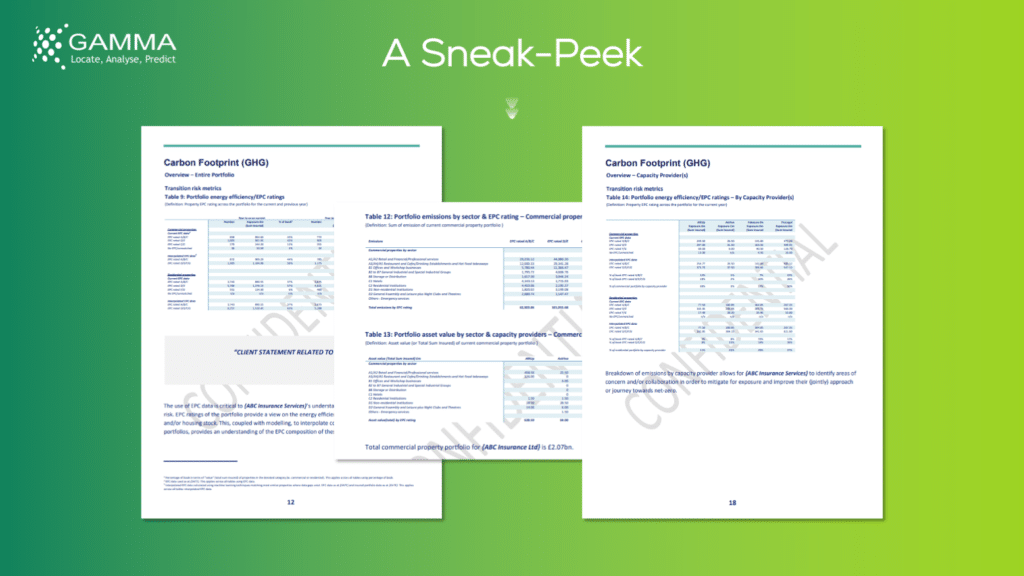

From an emissions perspective, a similar approach would be recommended – although clearly focused on the carbon footprint or greenhouse gas (GHG) emissions of properties insured using EPC data.

Slide Image 7: Report illustration for emissions (GHG)

Understanding of scope 3 insured emissions – be they residential, commercial, or by broad sector – is important not only for the client as they aim to transition towards achieving net-zero, but also for those that support the business from a capacity perspective.

Help is just a conversation away

Clearly – given the evidence and momentum that has seen climate-related pressures rise up the business agenda – this isn’t something that will be going away any time soon…

In fact, over the coming months – during 2023 and beyond – the clamour for visibility and insight will only become louder.

So, what do you do next?

Do you take control? Do you wait for clarity? Do you lead? Do you follow?

Or do you simply take a first step?

Regardless as to whether Gamma is part of your equation in this regard or not, the advice remains – stay flexible. Don’t confine yourself or your business unnecessarily.

What type of data would Gamma require from a client to produce the above report?

More than anything else, the intention is that this a simple, painless process.

That said, there are certain fields of data that would be required as a minimum to produce the aforementioned report, including:

How receptive does the MGAA feel that the market would be to this type of standardised report?

Drawing a parallel or analogy to the fair value requirement as mentioned, and in conversation with the regulator, then the MGAA would certainly encourage a standardised report – it has the potential to remove a lot of cost and enable a consistent view across multiple entities.

Certainly, as a starting point, from an association perspective, it would be something the MGAA would encourage.

From climate value at risk perspective, is it only flood that Gamma can provide a scenario-based prediction for, or can the report be produced for other perils?

No, a report on other perils is most definitely within our capability.

Whilst the initial focus has been on flood as the most obvious climate-related risk, Gamma can appraise the impact of other perils/hazards/risks such as subsidence and wildfire.

Gamma anticipates that these won’t be required as high a priority as flood in the first instance but are happy to work with a client to deliver what they need.

@ 2022 Gamma.ie by Jason Day

About Gamma Location Intelligence

Gamma Location Intelligence is a cloud hosted spatial solutions provider that integrates software, data and services to help our clients reduce risk through location intelligence. Established in Dublin, Ireland in 1993, and with offices in Manchester, UK and Bilbao, Spain, the company has expanded to become a global provider of innovative, cloud-hosted location intelligence solutions. Gamma Location Intelligence’s Perilfinder™ risk mapping platform provides property underwriters with access to trusted property-level risk data easily, quickly and accurately.